You say noise, I say data

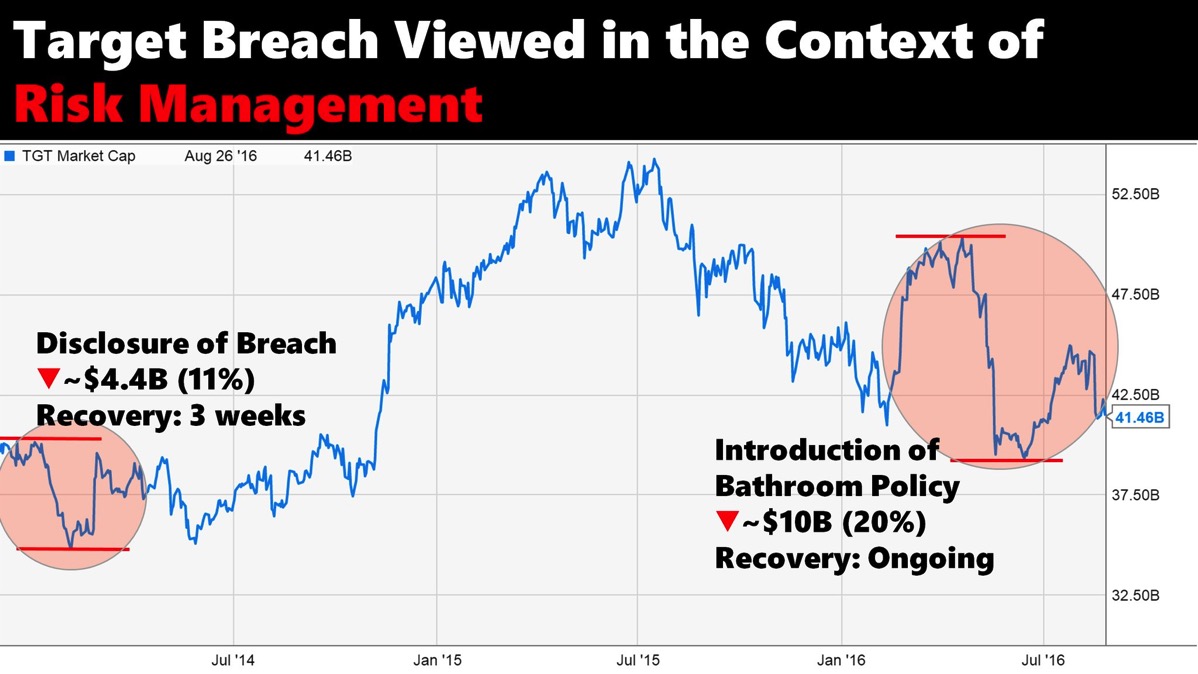

There is a frequent claim that stock markets are somehow irrational and unable to properly value the impact of cyber incidents in pricing. (That’s not usually precisely how people phrase it. I like this chart of one of the largest credit card breaches in history:

It provides useful context as we consider this quote:

On the other hand, frequent disclosure of insignificant cyberincidents could overwhelm investors and harm a company’s stock price, said Eric Cernak, cyberpractice leader at the U.S. division of German insurer Munich Re. “If every time there’s unauthorized access, you’re filing that with the SEC, there’s going to be a lot of noise,” he said.

(Corporate Judgment Call: When to Disclose You’ve Been Hacked, Tatyana Shumsky, WSJ)

Now, perhaps Mr. Cernak’s words been taken out of context. After all, it’s a single sentence in a long article, and the lead-in, which is a paraphrase, may confuse the issue.

I am surprised that an insurer would be opposed to having more data from which they can try to tease out causative factors.

Image from The Langner group. I do wish it showed the S&P 500.